Emerging Urban Air Mobility: The Weak Signal Transforming City Transportation Ecosystems

Urban air mobility (UAM) is evolving beyond niche experimental projects and early pilots into a weak yet powerful signal that could disrupt transportation, infrastructure, and urban planning across multiple regions. Emerging initiatives, such as air taxis, driven by rising urban congestion and technological advances, may reshape city travel dynamics within the next two decades. This transition could overturn entrenched patterns in mobility, real estate, health, and environmental sectors—especially in rapidly urbanizing regions like the Middle East and Africa.

What's Changing?

Rapid urbanization, population growth, and economic development are conspiring to exacerbate urban congestion globally while intensifying demand for innovative transportation solutions. A notable weak signal in this landscape is the increasing viability of air taxis—electric vertical takeoff and landing (eVTOL) vehicles designed for short intra-city travel—which are advancing from concept to operational pilot phases.

In regions such as the Middle East, particularly Saudi Arabia, major collaborations are underway to introduce air taxi services in congested cities like Riyadh and Jeddah, aiming to alleviate gridlocked road networks caused by dense populations and urban expansion (Travel and Tour World). This initiative aligns with broader infrastructure expansions and industrial strategies across Middle East and African markets, where urban growth drives demand for modernized transport and connectivity (OpenPR).

Globally, urban air mobility is poised to become a foundational element of future smart cities. Organizers at recent vertical mobility events emphasize moving beyond gimmickry to embed air taxis within sustainable urban ecosystems, inspired in part by planned deployments associated with events like the Olympic Games (Goodwood). This signals intent for adoption across other countries within the next decade.

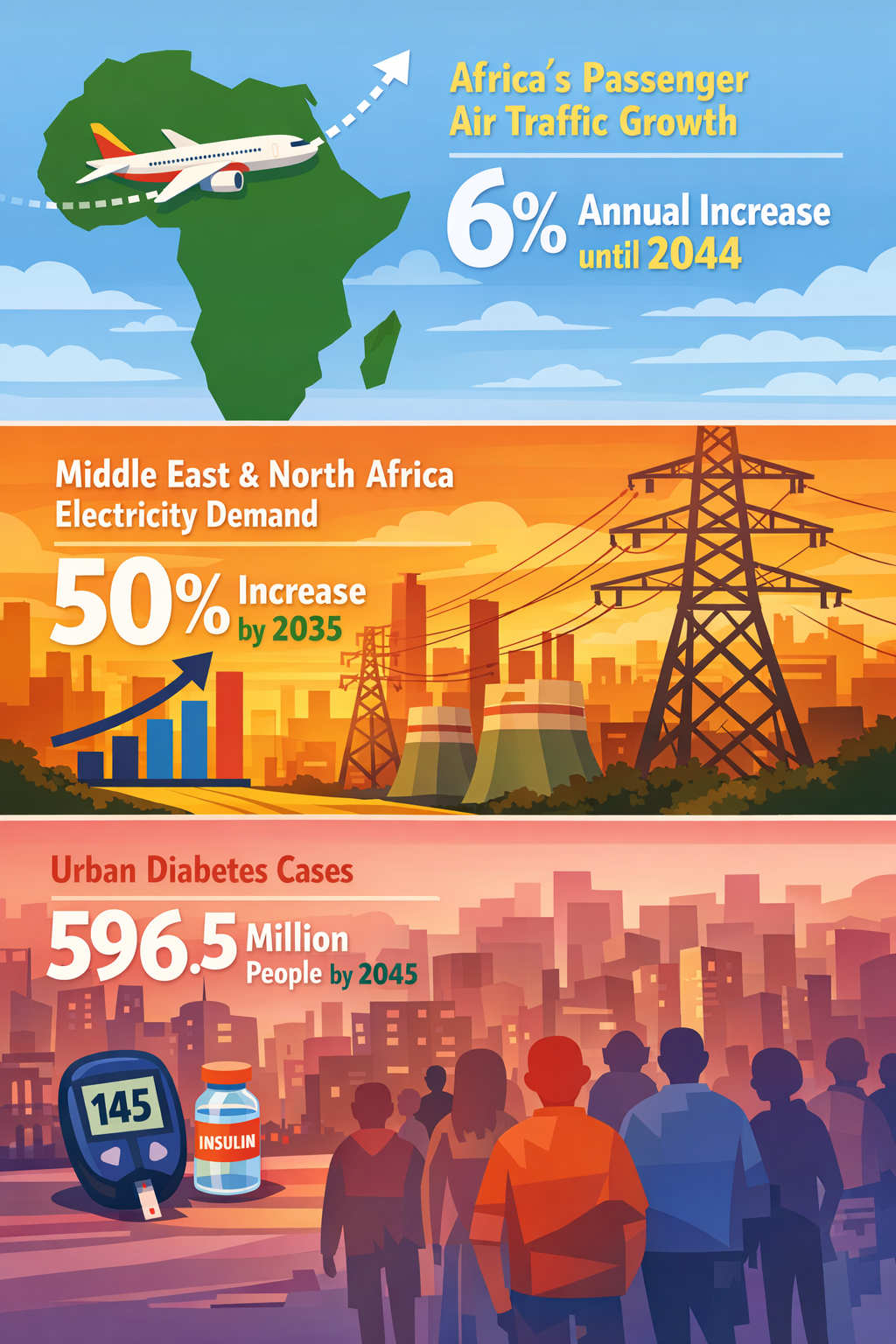

Such developments correspond with patterns of rapidly growing urban middle classes, particularly in Africa, where passenger air traffic is expected to increase annually by about 6% through 2044. This growth is driven by young populations, rising affluence, and investments in airport infrastructure, creating a fertile environment for innovative aerial transit solutions (AviTrader).

These trends also intersect with technological advances in battery technologies, autonomous systems, and air traffic management, enabling safer and more efficient urban air operations. Besides major metro areas in the Middle East and Africa, Asia-Pacific regions like Japan are exploring hydrogen-powered technologies, which may feed into the propulsion systems of future eVTOL vehicles, enhancing sustainability credentials (OpenPR).

Why is This Important?

Urban air mobility could transform the fundamental nature of city travel by introducing a new modal layer above ground traffic, offering alternatives where road infrastructure is constrained. This may enable:

- Reduced congestion and improved commute times in cities with limited expandability of road networks

- New access pathways connecting underserved urban sections, satellite towns, and key transport hubs

- Potential decongestion of ground-level transit ushering a more resilient, multi-modal urban ecosystem

- New economic development opportunities in manufacturing, operations, maintenance, and air traffic control sectors

The impact may be profound in fast-growing urban centers in the Middle East and Africa, where traditional infrastructure struggles to keep pace with urbanization and rising middle-class mobility demands (OpenPR; Travel and Tour World).

Moreover, urban air mobility could reduce environmental externalities by enabling electrically powered aircraft to replace some short-trip car journeys, helping cities achieve emission reduction goals.

Implications

The integration of air taxi services and urban air mobility will challenge existing regulatory frameworks, urban spatial planning, and public acceptance. To prepare for these disruptions, stakeholders should consider:

- Urban planners and municipal governments need to begin integrating vertical takeoff and landing infrastructure—such as vertiports—within city development plans, addressing noise, safety, and accessibility concerns.

- Transport authorities must collaborate to update air traffic management systems adaptable to dense urban airspace with low-flying eVTOL operations alongside traditional aviation.

- Economic developers and investors should anticipate growth in ancillary industries such as battery supply chains, electric propulsion manufacturing, and maintenance services.

- Urban healthcare and environmental sectors could see new challenges and opportunities; for example, reduced traffic congestion might improve urban air quality, but increased aerial activity might raise noise or safety concerns.

- Technology and automotive companies may face competitive disruption or convergence as traditional automotive transit overlaps with burgeoning aerial mobility platforms.

- Social equity considerations must be prioritized to ensure new mobility options do not exacerbate existing disparities but rather expand access to affordable urban transport.

Given these factors, early investments in research, pilot projects, and cross-sector collaboration offer the best chance to shape urban air mobility into a sustainable, inclusive component of future city life rather than a fragmented luxury service.

Questions

- How can regulators design flexible aviation policies that enable urban air mobility innovation while ensuring safety, privacy, and community acceptance?

- What urban infrastructure investments can maximize the integration of vertiports with existing transit hubs to optimize passenger convenience and network efficiency?

- In what ways might air taxi deployment intersect with environmental goals—can these services lead to net reductions in urban carbon emissions?

- What business models will emerge to ensure affordability and accessibility of aerial urban transit to broad socioeconomic groups?

- How can urban planners anticipate potential changes in land use and property values fueled by new aerial transit corridors?

- What partnerships between technology firms, governments, and communities are necessary to navigate social acceptance and regulatory hurdles?

Keywords

urban air mobility; air taxis; eVTOL; Middle East urbanization; African airport investments; sustainable transport; smart cities

Bibliography

- Africa's passenger air traffic is expected to grow at an average annual rate of 6% through to 2044, driven by a young population, a rising middle class, rapid urbanization and increasing investment in airports and connectivity. (AviTrader)

- Organisers emphasise that air taxis are not a gimmick and believe they will leave an Olympic legacy of a different kind, where the smart city blueprint could be adopted by other countries within a decade. (Goodwood)

- Air taxis have the potential to drastically reduce traffic congestion in major cities like Riyadh and Jeddah, where road networks are often congested due to high population densities and rapid urbanization. (Travel and Tour World)

- Middle East & Africa demonstrates emerging opportunities, driven by infrastructure expansion, industrialization, and urbanization. (OpenPR)

- The APAC region is expected to experience the fastest growth, driven by Japan's early leadership in hydrogen water technology, rising urbanization, and increasing disposable income across emerging economies. (OpenPR)