Emerging Disruption in North American Nearshoring: The Rise of Integrated Regional Logistics Ecosystems

North American manufacturing and trade are undergoing a subtle yet profound transformation driven by nearshoring—relocating production closer to end markets. This movement, while widely discussed, harbors an underappreciated weak signal: the emergence of fully integrated, technology-enabled regional logistics ecosystems. These ecosystems blend investment in geographic hubs, supply chain resilience, and digital infrastructure. They may disrupt traditional global logistics models, redefining freight flows, supplier networks, and manufacturing footprints.

Introduction

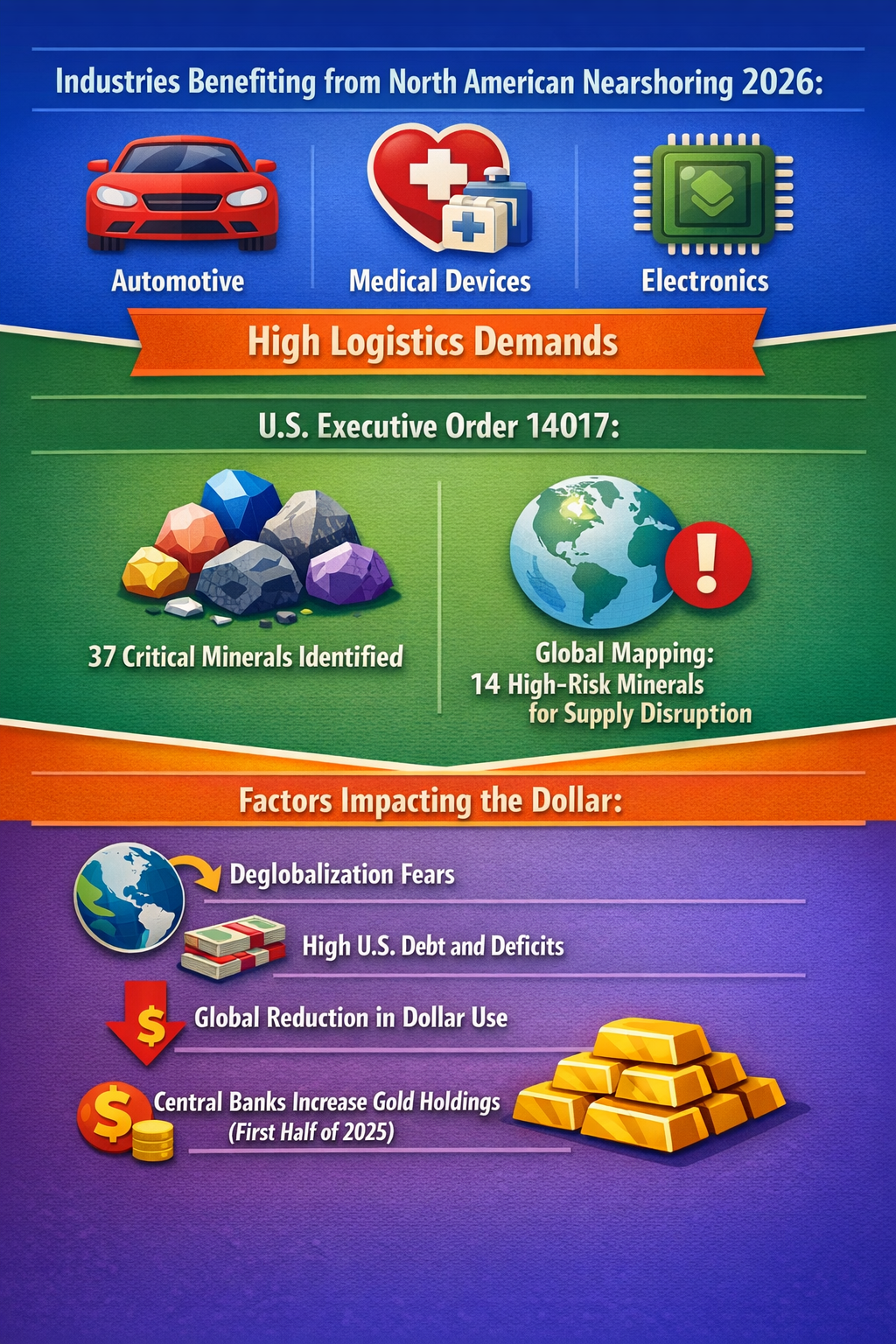

The intensification of nearshoring activity in North America, particularly involving Mexico and the U.S., is more than simple geographic relocation. Beyond tariff risk management and supply chain resilience, a new pattern emerges around the creation of interconnected logistics networks concentrated in strategic regions. This shift integrates advanced manufacturing assets with tailored logistics infrastructure supported by digital and automation technologies. It forms a novel supply chain construct that could reshape how goods are moved, manufactured, and delivered across industries such as automotive, electronics, medical devices, and more.

What’s Changing?

Recent developments reveal multiple, converging forces reshaping North American industrial and logistics landscapes. First, nearshoring incentives and policies, especially in Mexico, are drawing diverse manufacturing investments not only to traditional industrial hubs but also to emerging coastal and interior locations (Mexico CRE News). This diversification broadens the geographic footprint of regional supply chains.

At the same time, logistics providers are reevaluating their capabilities based on adaptability, regional presence, and technology adoption (Tucson.com). Freight patterns are expected to realign significantly by 2026, as tightening truck capacity and cross-border freight volumes reconfigure transport corridors, emphasizing flexibility and responsiveness to regional demand fluctuations (NDT AHQ).

Fourth-party logistics (4PL) providers are expanding aggressively into Southeast Asia, Eastern Europe, and Latin America to reduce risks and facilitate nearshoring strategies (Precedence Research). These moves suggest a global network dynamic where regional hubs connect with strategic manufacturing clusters. The shift away from traditional globalized supply chains towards more segmented, friendshored linkages further complicates logistics planning (SWZMaritime).

Investments in advanced fabrication plants in diverse geographies seek to re-balance production and control bottlenecks exposed during recent crises (Observer News Online). Automated logistics, AI-enabled forecasting, and robotics are quietly becoming integral to supply chain operations, enhancing consistency and reducing errors across this evolving ecosystem (Biospace.com).

The U.S. and other governments are concurrently supporting supply chain resilience through critical mineral strategies and industrial policies linked to national security, reinforcing the connections between raw materials sourcing, manufacturing, and logistics infrastructure (Gov.uk; UK Critical Minerals Strategy).

Moreover, regional manufacturing centers, especially in Mexican cities such as Queretaro and Saltillo, are exhibiting real estate dynamics that reflect growing industrial activity and the need for infrastructure upgrades to sustain growth (Oaxaca Real Estate). Such changes hint at how intertwined industrial expansion and urban development become within nearshored ecosystems.

Why is this Important?

The integration of manufacturing expansion, logistics evolution, and policy support signals a structural change with multi-sector impacts. Traditional global supply chains may face pressure from this new, geographically concentrated and technologically sophisticated model that enhances resilience and operational agility.

Industries relying on just-in-time production or high logistics demands—automotive, medical devices, electronics—stand to gain from more localized, adaptable supply chains but must also manage increased complexity in supplier networks (The Cooperative Logistics Network; Blog).

Transportation sectors could experience disruption in freight flows, with major shifts in demand for cross-border trucking capacity and regional fulfillment centers. Logistics providers who fail to invest in adaptability and technology integration risk losing market relevance as customers prioritize agility over cost alone (Tucson.com; NDT AHQ).

At a macroeconomic level, the establishment of nearshoring hubs supported by tax incentives and streamlined procedures in Mexico is likely to attract sustained foreign direct investment, strengthening regional economies but also necessitating robust infrastructure development and environmental planning (DiscoveryCRE.com; Mexico CRE News).

The growing necessity for supply chain antifragility, defined as systems that improve under stress, will prompt businesses to move beyond mere resilience towards dynamic adaptation. This will require integrating digital tools, supplier diversification, and real-time data flows within these ecosystems (L2L.com).

Implications

Businesses, governments, and investors will need to reconsider traditional supply chain and logistics strategies to accommodate these emerging nearshoring-driven ecosystems. The implications include:

- Supply Chain Design: Adoption of multi-node, regional logistics hubs with digital integration may replace linear, global supply chains.

- CapEx and Infrastructure: Investments must prioritize not only manufacturing capacity but also tailored logistics infrastructure capable of handling fluctuating, regional freight volumes efficiently.

- Technology Integration: Deployment of automation, AI analytics, and robotics in logistics and manufacturing operations will become essential for tracking, optimization, and error reduction.

- Policy Synergies: Harmonized policy frameworks, including tax incentives and streamlined customs procedures, will enhance or constrain the growth of nearshoring hubs.

- Labor and Skills Development: The ecosystems will require skilled labor in technology management and advanced manufacturing, prompting changes in workforce development programs.

- Supplier Networks: Firms must cultivate deeper, localized supplier relationships to avoid becoming mere assembly points and to ensure long-term supply chain resilience (SCMR).

These developments could lead to a viable alternative global supply chain architecture that balances cost, risk, and responsiveness. It may also reduce geopolitical risks associated with overdependence on distant manufacturing regions, reinforcing strategic autonomy especially in critical sectors like defense and healthcare (Gov.uk; DiscoveryAlert.com.au).

Questions

Strategic planners should consider the following questions to navigate the future of nearshoring logistics ecosystems effectively:

- How can organizations balance investments between manufacturing capabilities and the digital/physical logistics infrastructure needed for integrated regional ecosystems?

- What partnerships with logistics providers and local governments can create resilient, adaptable supply chains in nearshoring hubs?

- How might tariff and trade policy shifts impact the viability of different regional clusters over the next decade?

- What role should emerging technologies—such as AI-driven supply chain analytics and autonomous freight movement—play in future ecosystem design?

- How can workforce development be aligned to address specialized skills needed for operation and maintenance of advanced, integrated supply chains?

- What frameworks can measure and enhance the antifragility—not just resilience—of supply chains in nearshored regions?

Keywords

nearshoring; supply chain resilience; logistics ecosystems; automation; digital infrastructure; regional manufacturing; critical minerals; supply chain antifragility

Bibliography

- Nearshoring, Mexico investment, and tightening truck capacity could reshape North American freight flows in 2026. NDT AHQ.

- Retailers accelerate nearshoring and regional fulfillment efforts affecting logistics providers. Tucson.com.

- North American nearshoring beneficiaries and logistics demands. The Cooperative Logistics Network Blog.

- Plan Mexico tax incentives and simplified procedures locking in nearshoring. DiscoveryCRE.com.

- Industrial hubs and emerging regions: Mexico real estate and infrastructure demands. eSales International.

- Automation and robotics as foundational technologies in supply chain resilience. Biospace.com.

- UK critical minerals strategy supporting national supply chain resilience. Gov.uk.

- Friendshoring and nearshoring driving trade route restructuring and port disruptions. SWZMaritime.

- Domestic supplier networks critical for supply chain resilience in U.S. reshoring. Supply Chain Management Review.

- Antifragility as the new paradigm in supply chain resilience. L2L.com.

- Fourth-party logistics global expansion supporting nearshoring strategies. Precedence Research.