The Emerging Convergence of Satellite and 5G Networks: A Weak Signal That May Disrupt Global Connectivity

Satellite internet and fifth-generation (5G) mobile networks have evolved largely as parallel infrastructures, addressing different needs in digital connectivity. However, a subtle yet critical development suggests these technologies could soon merge into a unified system. This convergence may usher in unprecedented opportunities and challenges across telecom, manufacturing, defense, and government sectors. By exploring recent expansions in satellite constellations, shifts in network architectures, and interoperability concerns, this article reveals a weak signal of change with the potential to disrupt industries globally.

What’s Changing?

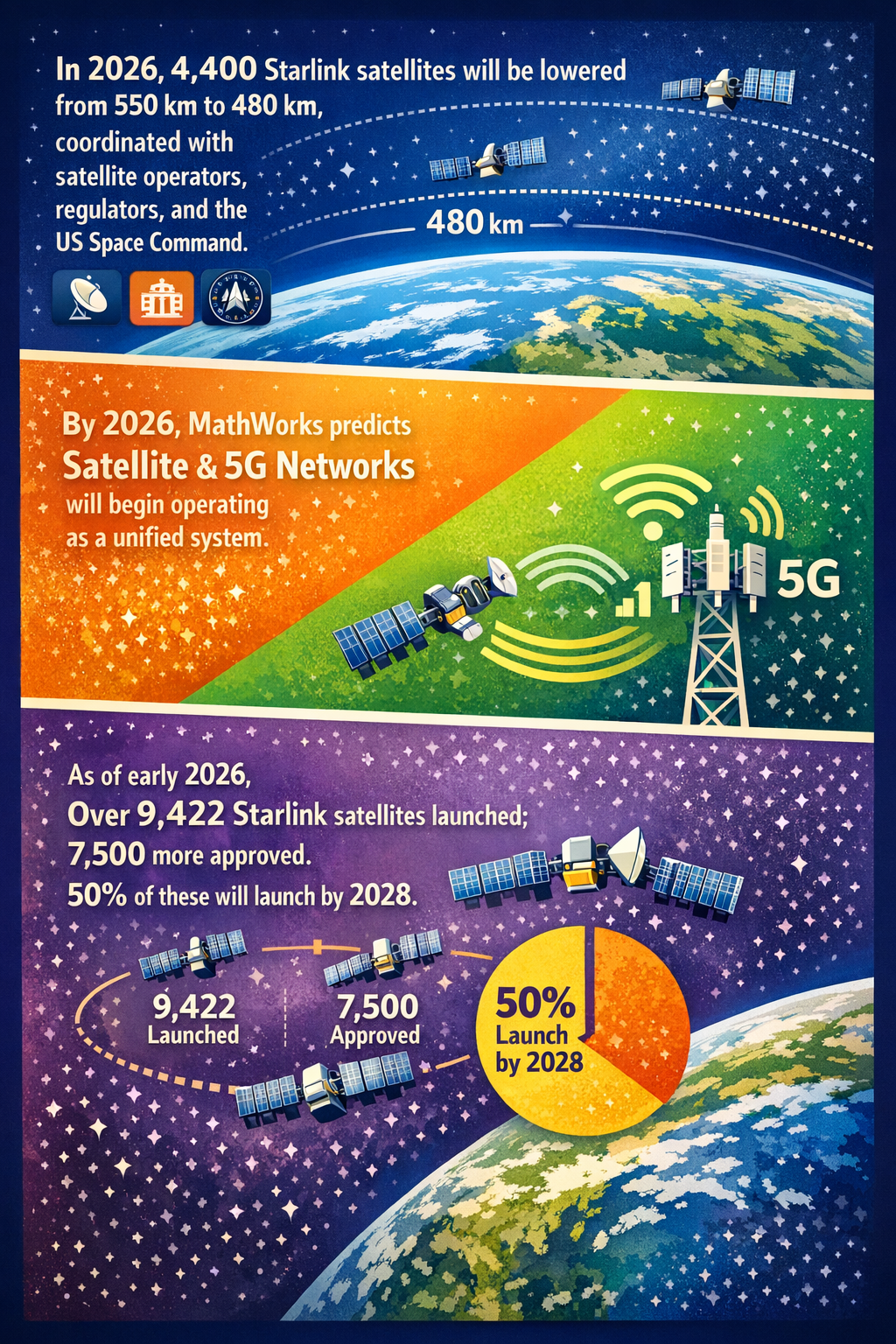

The satellite internet landscape is expanding rapidly, driven primarily by ambitious projects such as SpaceX’s Starlink, which plans to deploy up to 42,000 low Earth orbit (LEO) satellites, with over 30,000 already approved (Gizmodo). As of early 2026, Starlink has launched more than 9,400 satellites and aims to launch half of its approved constellation by 2028 (Baiguan News). Meanwhile, competitors like Russia’s Zorky system aim to establish domestic LEO constellations exceeding 300 satellites to rival Starlink, highlighting a push toward national sovereignty in satellite-based internet services (Geopolitics Unplugged).

Concurrently, 5G technology continues its rapid adoption trajectory, with forecasts indicating it will carry 83% of all mobile data traffic by 2031—up from 34% in 2024 (Mobile Industry Review). The 5G ecosystem is also advancing beyond mere connectivity to support ultra-reliable low latency communications essential for industrial IoT (Internet of Things) and edge computing applications (Digital IT News).

A pivotal insight originates from MathWorks, which projects 2026 as a critical inflection point when satellite and 5G networks begin operating as a unified system rather than as parallel infrastructures (Voice & Data). This potential integration leverages the expansive coverage and high bandwidth of satellite constellations with the low latency and localized performance of terrestrial 5G networks, fostering a new hybrid connectivity paradigm.

Further enabling this hybrid model is the advancement of edge AI-enabled devices paired with ultra-reliable 5G connectivity and digital twins, which collectively are making real-time predictive maintenance standard practice in manufacturing by 2026 (Manufacture Now). The technology stack required to unify satellite and 5G networks appears to be converging, supported by innovations in AI, edge computing, and network management.

Yet, geopolitical factors are intensifying the complexities around this transformation. The fragmentation of technology standards, particularly between Western and Chinese ecosystems, threatens to constrain global addressable markets and risk stranded investments in incompatible infrastructures (BBH Insights). Additionally, crowded orbits and growing satellite deployment raise concerns about space security and the risk of conflict, illustrated by near-miss incidents involving US-affiliated Starlink satellites and Chinese spacecraft (VinylOne).

This changing connectivity landscape is also evident in aviation. Lufthansa’s commitment to equip its 850-aircraft fleet with Starlink shows immediate commercial interest in satellite-5G hybrid services for in-flight connectivity (KeepTrack Space). This suggests that cross-sector adoption of integrated satellite and terrestrial networks could accelerate as service quality and coverage improve.

Why is This Important?

The convergence of satellite and 5G networks could reshape global telecommunications by creating a unified, highly resilient infrastructure that transcends geographic and technological limitations. Hybrid networks might finally close the persistent digital divide experienced by rural, remote, and underserved regions where terrestrial 5G infrastructure alone typically proves uneconomical.

This transformation could substantially benefit industries relying on dependable real-time data and connectivity—such as manufacturing, logistics, defense, and aerospace—by providing more reliable backhaul, enhanced predictive maintenance capabilities, and global IoT device coverage (RTInsights; Manufacture Now). The accelerated adoption of AI-powered edge devices supported by integrated networks might optimize operational efficiencies at scale.

However, this shift poses regulatory and geopolitical challenges. As countries like Russia invest in sovereign satellite constellations and diverging standards fragment the global landscape, international cooperation and regulatory alignment will become vital to avoiding market segmentation and technological incompatibility (Geopolitics Unplugged; BBH Insights). Space traffic management also emerges as an increasing concern, with potential disruptions from space congestion and militarization threatening the delicate balances required for ecosystem interoperability.

For policymakers, businesses, and defense agencies, these developments imply a need to reconsider existing infrastructure investments, security postures, and strategic partnerships. Commercial players aiming for global scale may have to navigate both technological integration and geopolitical risk layering strategies.

Implications

The anticipated integration of satellite and 5G networks suggests several strategic implications:

- Network Architecture Redesign: Telecom providers may need to rethink their architecture to embrace hybrid satellite-terrestrial connectivity, optimizing bandwidth and latency dynamically across diverse environments.

- New Market Opportunities: Providers can develop nascent satellite IoT markets, projected to exceed 32 million subscribers by 2029, by delivering continuous global coverage unavailable through terrestrial 5G alone (RTInsights).

- Regulatory Convergence and Standards Alignment: Governments and international bodies might accelerate efforts to harmonize standards and spectrum allocations to prevent fragmentation and protect investments.

- Security and Risk Management: Defense and commercial sectors need frameworks to address vulnerabilities inherent in space assets, especially considering emerging threats like weaponized satellite terminals in conflict zones (Drone Warfare).

- Space Traffic and Sustainability Governance: Coordination between satellite operators, regulators, and defense agencies will be essential to mitigate collision risks from expanding constellations and maintain orbital safety (NASA Spaceflight).

- Cross-sector Innovation Acceleration: Integration can enable new service models, such as enhanced in-flight connectivity (Lufthansa) and factory-level IoT-driven autonomy, catalyzing broader digital transformation across sectors.

Strategic planners should monitor technology vendors’ roadmaps closely and engage in multistakeholder forums shaping future satellite-5G ecosystems. Investments in testing hybrid network deployments can provide early insights on operational benefits and gaps. Organizationally, flexibility in infrastructure integration strategies may hedge against geopolitical risks related to fractured technology ecosystems.

Questions

- How can businesses prepare to leverage hybrid satellite and 5G networks to enhance operational resilience and global market reach?

- What regulatory frameworks and international collaborations are necessary to enable harmonized satellite-terrestrial network integration?

- How might geopolitical tensions and fragmented technology standards impede or accelerate the development of unified connectivity infrastructures?

- What security strategies should organizations adopt to mitigate emerging risks linked to satellite network militarization and space traffic congestion?

- In what ways could industries outside telecommunications, such as manufacturing and aviation, exploit combined satellite-5G networks for new digital services and products?

- Which emerging technologies (e.g., edge AI, digital twins) could accelerate or depend on the success of unified satellite and 5G infrastructures?

Keywords

satellite internet; Starlink; 5G networks; low Earth orbit; IoT; edge AI; network integration; digital twins; geopolitical risk; space security

Bibliography

- As SpaceX continues to expand its satellite fleet, potential users and enthusiasts can anticipate enhanced services across more remote and underserved areas, boosting competition and innovation in the satellite internet landscape. KeepTrack.Space

- In a notable partnership, the Lufthansa Group announced it will equip its fleet of 850 aircraft with Starlink technology, aiming to enhance in-flight internet services for passengers. KeepTrack.Space

- The fragmentation of technology standards - China's developing parallel ecosystems in everything from telecommunications (5G) to payment systems - will constrain addressable markets and create stranded investments in incompatible technologies. BBH Insights

- By 2026, IoT adoption is expected to accelerate as AI-powered edge devices become more capable, reducing latency and improving real-time decision-making. Digital IT News

- SpaceX plans to launch up to 42,000 Starlink satellites and so far has received approval for 30,000. Gizmodo

- As of early 2026, Starlink has already launched over 9,422 satellites, and an additional 7,500 satellites were approved a few days ago, with 50% to be launched by 2028. Baiguan News

- Starlink’s IPO could help establish satellite internet as a defined and measurable category alongside traditional telecom and broadband services. Yahoo Finance

- MathWorks, a developer of mathematical computing software has projected a significant shift in the global connectivity landscape, with 2026 expected to mark the point at which satellite and 5G networks begin operating as a unified system rather than as parallel infrastructures. Voice & Data

- By 2026, the integration of Edge AI, ultra-reliable 5G connectivity, and advanced digital twins will make predictive maintenance not just an option, but a standard operating practice for competitive manufacturers. Manufacture Now

- With predictions citing that the global subscriber base will reach more than 32 million by 2029, satellite IoT is rapidly shifting from early adoption to scaled deployment. RTInsights

- The fragmentation of technology standards and geopolitical competition could constrain technologies and create stranded assets. Geopolitics Unplugged

- The near miss involved a Starlink satellite tied to US strategic interests and a newly launched Chinese spacecraft, raising fears that crowded orbits could trigger the first serious space confrontation between Beijing and Washington. VinylOne

- Russia's integration of booby-trapped Starlink terminals into strike drones transforms downed UAVs into secondary threats, weaponizing counter-drone recovery operations. Drone Warfare

- During 2026, roughly 4,400 Starlink satellites currently operating at an altitude of around 550 km will be lowered to 480 km in a process coordinated with regulators and the US Space Command. NASA Spaceflight