Since our robot's last look at energy futures in November 2017, oil prices have shifted upwards. The short-term, forward look contains a lot of uncertainties given increasing geopolitical and other national policy issues and these will have long-erm effects too.

gas

- Oil and gas will still account for 44% of world primary energy supply in 2050.

- Gas will be the largest single source of energy from 2034.

- The EIA release showed that natural gas contributed 32% to total energy generation in 2017: Its share is expected to go up to 33% in 2018 and further increase 100 basis points to 34% in 2019: the share of coal is expected to drop from 30% in 2017 to 28% in 2019.

- For the Europeans, deeper transatlantic energy cooperation - notably increasing imports of US liquefied natural gas - could help to improve the trade balance with the US.

sales

- Demand for crude oil will flatten out in the period 2020-2028 fall significantly as sales of light electric vehicles surge.

- European electric-vehicle sales will rise to about 5 percent in 2021 and take off from 2025.

- In the year 2030, electric vehicles (EVs) will make up just 7% of new car sales in India, owing to a shortage of charging infrastructure and a lack of affordable models.

- Electric vehicles will make up 54% of new car sales by 2040.

- EVs could account for 30% of UK new car sales by 2030.

energy

- The U.S. Department of Energy has projected that "domestic hydropower could grow from 101 gigawatts to nearly 150 gigawatts of combined electricity generation and storage capacity by 2050.

- The US Department of Energy predicts around 22,000 MW of offshore wind by 2030.

- China is expected to achieve grid parity-when an alternate source of energy is as cheap or cheaper than power purchased from the grid-only by 2022.

- China may see an opportunity to strike energy deals with the Iran despite the American sanctions.

- Laptop and phone batteries could last 100 times longer if boffins at the University of Missouri come good on a new honeycomb design that they say greatly reduces the amount of energy dissipated inside power packs.

- The move to solar will provide Spanish citizens with cheaper access to energy, a halving in CO2 emissions and will create extra revenue as power exports to France would increase by around 236%.

- Trump wants America to be energy self-sufficient and will encourage the development of US shale gas reserves as a source of low-emission.

- Gas will be the largest single source of energy from 2034.

companies

sources

- Trump wants America to be energy self-sufficient and will encourage the development of US shale gas reserves as a source of low-emission.

- China is expected to achieve grid parity-when an alternate source of energy is as cheap or cheaper than power purchased from the grid-only by 2022.

- Gas will be the largest single source of energy from 2034.

- Existing hardware combined with renewable energy sources will not affect the world's energy consumption all that much.

- Blue energy, which is the free energy lost when salty sea water and less salty river water meet and mix in estuaries, could become a significant source of global electricity in the future.

- By combining flexible nuclear power plant operation with the use of variable renewable energy sources, Europe will be able to ensure security of energy supply while reducing its greenhouse gas emissions.

- By 2030, 50% of total electric power generation will be from non-fossil energy sources.

demand

- Demand for copper, high-purity nickel, cobalt and lithium used in the manufacture of EV battery packs is forecast to rise 31 times, 42 times, 19 times and 29 times respectively to 2030.

- The global LNG market is expected to grow with rising energy consumption, growing urban population, increasing demand of natural gas vehicles, accelerating economic growth and increasing preference of LNG in developing economies.

- Billion-pound ($2.2 billion) program will provide infrastructure to support the take-up of EVs and help reduce strain on the grid from the demands of massive EV charging and intermittent renewable energy.

- The demand for batteries both in the EU and globally will grow exponentially in the next years.

- The Paris-based International Energy Agency warned that recent strength in demand for oil could soon moderate.

- Demand for crude oil will flatten out in the period 2020-2028 fall significantly as sales of light electric vehicles surge.

- By 2022, Chinese demand for electric cars will triple, and the largest bloc - 39% - will be SUVs and crossovers.

supply

- The loss of Iranian barrels could tighten supplies of Middle Eastern medium-sour crudes and be supportive of Dubai oil.

- By combining flexible nuclear power plant operation with the use of variable renewable energy sources, Europe will be able to ensure security of energy supply while reducing its greenhouse gas emissions.

- Concerns about national security and energy supply could prompt further bids to drill for oil in the Great Australian Bight.

- The conflict in Yemen could disrupt global energy supplies and boost prices.

- Global oil supplies could be hit by President Donald Trump's decision to pull the US out of the Iran nuclear deal.

- Oil and gas will still account for 44% of world primary energy supply in 2050.

vehicles

- The rollout of 540 million electric vehicles by 2040 will cause oil demand to peak in the mid-2020s, slashing income by $19 trillion.

- In the year 2030, electric vehicles (EVs) will make up just 7% of new car sales in India, owing to a shortage of charging infrastructure and a lack of affordable models.

- Within the next eight years, electric vehicles will be as cheap as gasoline vehicles.

- Electric vehicles will make up 54% of new car sales by 2040.

- The global LNG market is expected to grow with rising energy consumption, growing urban population, increasing demand of natural gas vehicles, accelerating economic growth and increasing preference of LNG in developing economies.

- Pivot Power has unveiled plans to build a world-first 2GW network of grid-scale batteries and rapid electric vehicle (EV) charging stations across the UK: The £1.6 billion program will provide infrastructure to support the rapid adoption of EVs and underpin clean air policies.

production

- A recent U.S. Energy Information Administration ("EIA") release projected that coal production in the United States will drop 3% year over year to 751 million short tons (MMst): Coal production is expected to remain flat in 2019.

- WTI is expected to be relatively weaker versus other benchmarks on the back of growing Cushing stockpiles and increasing domestic production in the U.S.

- Global companies like General Electric are using AI to boost different forms of energy production and pull from tech-driven data reports to anticipate performance and maintenance needs around the world.

- U.S. petroleum and other liquid fuels production is expected to increase, reaching 17.6 million b/d in 2018 and 19.1 million b/d in 2019, up from 15.6 million b/d in 2017.

wind

- In a world where wind and solar resources make up 40 to 50 percent of generation, wholesale energy prices will drop by as much as $16 per megawatt-hour.

- Repowering projects are expected to make up a growing share of winning bids in Germany's onshore wind auctions through 2023.

- The US Department of Energy predicts around 22,000 MW of offshore wind by 2030.

- Revolution Wind will help Rhode Island meet its own target for 1 GW of renewable energy (though not offshore wind specifically)

- By 2020, onshore wind will be hitting an LCOE of $50 per megawatt-hour and solar will be at $60 per megawatt-hour.

emissions

- By combining flexible nuclear power plant operation with the use of variable renewable energy sources, Europe will be able to ensure security of energy supply while reducing its greenhouse gas emissions.

- By the 2050s BECCS could deliver roughly 55 million tonnes of net negative emissions a year in the UK.

- Australia will be unable to meet its commitment to reduce economy-wide emissions by 28% below 2005 levels by 2030.

consumption

- Investment in nuclear power and renewable energy will likely lead to much lower rates of abstraction and consumption by 2050.

- Electrical consumption is expected to grow at an annualized rate of 0.5% over the five years to 2023.

- The global LNG market is expected to grow with rising energy consumption, growing urban population, increasing demand of natural gas vehicles, accelerating economic growth and increasing preference of LNG in developing economies.

- Further investment in nuclear power and renewable energy sources will inevitably lead to lower abstraction rates and water consumption by 2050.

- Existing hardware combined with renewable energy sources will not affect the world's energy consumption all that much.

|

Questions |

Do contact us to see how we can help you track future energy developments as they are announced or reported.

Sentiment analysis

Recent improvements in sentiment towards energy come from increasing annoucements on more use of wind and solar power in the U.S. and Europe, expectations of much more efficient batteries and energy storage systems including vehicle-to-grid are on the horizon.

.jpg)

The shift towards electric vehicles will see demand for traditional road transport fossil fuels replaced with demand for electricity.

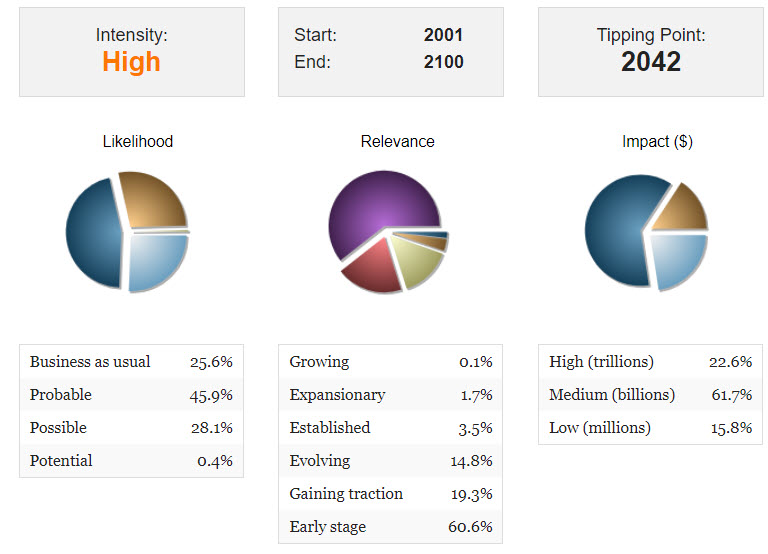

Pie charts

It's 31 years since the Bruntland Commission first coined the term sustainable development, including energy in its ambit. Though renewable energies are gaining momentum, particularly in Europe and China, Asia and Africa still have a long way to go to wean themselves off oil and coal. Athena thinks the tipping point for global acceptance of the need for universal renewable energy will likely take another generation until 2042. The difference between electric cars and gasoline cars will only grow-cementing the role of electric vehicles in halving U.S. oil use and cutting global warming emissions.

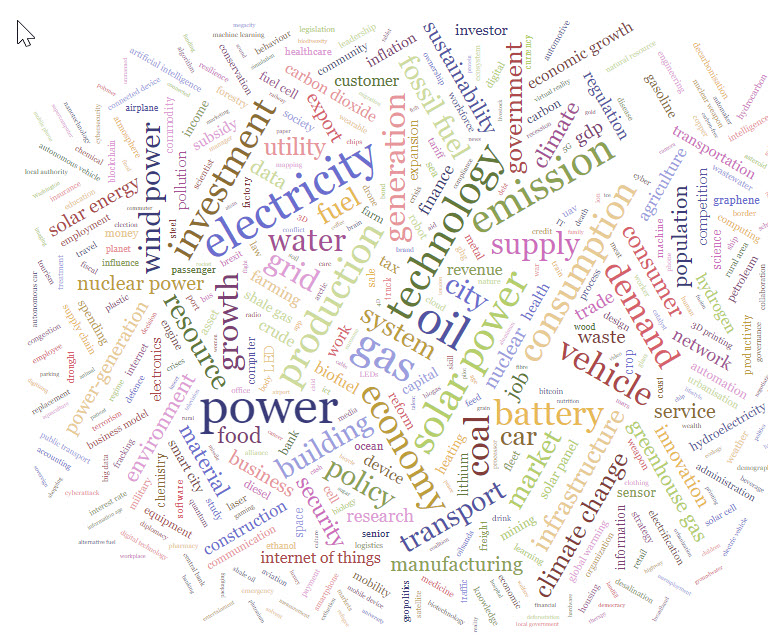

Cloud

We are showing the cloud this week to bring home the point that our world relies on traditional energies with renewables not yet the dominant force and unlikely to be until well into the 21st century.

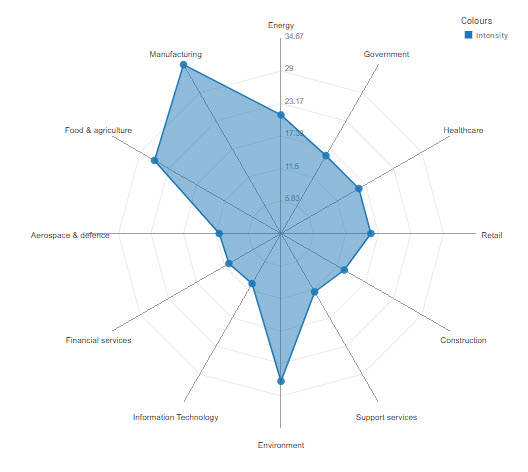

Radar

The top ten sectors most likely affected by changes in future energy policy and pricing will be manufacturing, food & agriculture, the environment, energy, government, retail, healthcare, construction, support services, aerospace and defense. But, the top three: manufacturing, food & agriculture, and the environment stand out as the key sectors likely to experience transformative change. All ten sectors are likely to continue looking for energy savings as global economic growth continues a low and possible, future recessionary path from 2019 onwards bringing the benefits of reduced resource use, less pollution, lower energy costs and distributed power.

Graph-It

Five years from now we are likely to see the better use of energy systems in smart cities, better batteries and states, particularly the US becoming increasingly energy independent as new technologies come on stream.

.jpg)

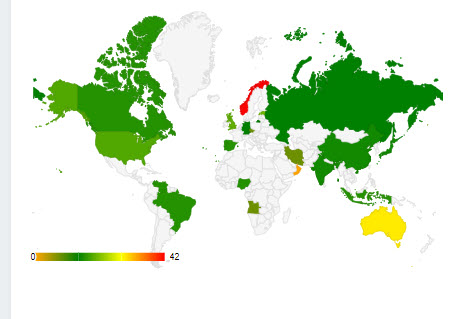

Heat Map

Late to the party and despite Donald Trump' withdrawal from the Paris agreement and emaciation of the EPA, the US is likely to continue to benefit from its shale gas projects and major investments in solar and wind. By 2040, Canada and the USA are projected to double 2015 production of shale gas. The United States is already a net exporter of natural gas because of growing shale gas production. Trump is not seeing the boost in coal production he promised at the time of his election. Per an EIA release, US coal exports will drop to 88.1 million tons in 2018 and further decline to 84.6 million tons in 2019.

And, adoption of solar power is occurring rapidly in Australia and soon will account for about 90% of residential energy consumption and meet about 50% of the country's needs. Australia could become a superpower in exports of renewable energy in the medium term.

.jpg)

Geography

The world will need much more energy to sustain the expected extra two point seven billion people that will likely inhabit the Earth by 2050. Asia and Africa are expected to represent almost 80% of the world's population by 2050.

More than half of the global population growth leading up to 2050 will occur in Africa and Africa's population is expected to expand by 1.3 billion. The majority of the increases will come in India, China and Nigeria. India is expected to account for 30-40 percent of overall demand growth for energy in the next two decades.

The U.S. and Australia are becoming independent of energy imports and will likely be major exports, while Russia continues to look for oil and gas export markets to sustain its sanction restrained economy. Iran will follow suit soon.

Continued geopolitical issues particularly affecting Venezuela, the Middle East and Western and Eastern Europe are likely to create continued volatility in energy prices in a very complex market.

Sectors

Energy is an expensive commodity for most organizations so its no surprise that most sectors have his as very high on their priorities.

.jpg)

Influencers

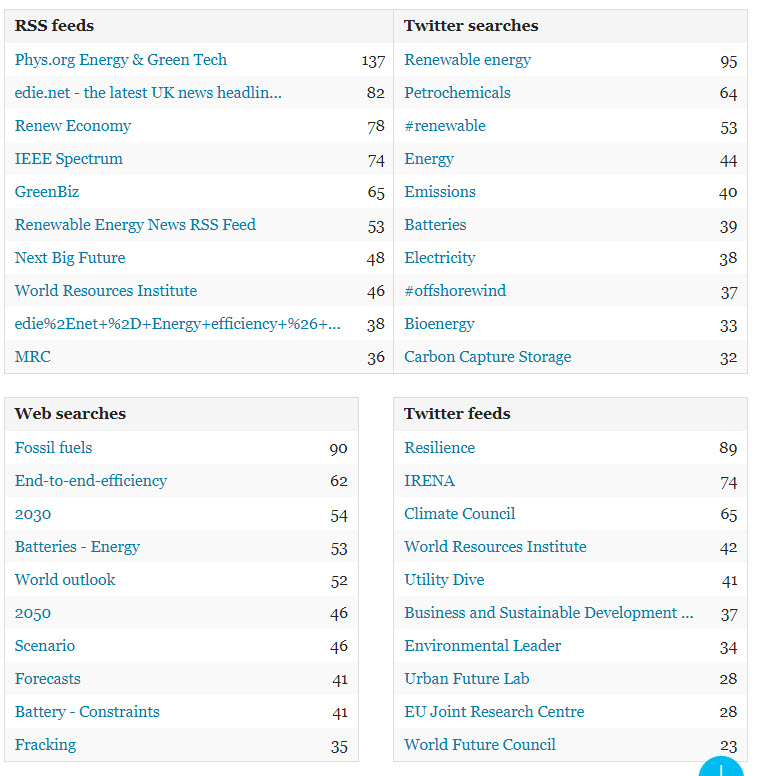

The chart below shows the key influencers Athena used to create this report. It's becoming increasingly noticeable across most topics we have recently covered that the EU is having considerable influence on regulatory matters: energy is no exception.

Sources

Athena used the sources below as the top ones to create this report and determined which embedded forecasts are included in this Trend Alert. She found 18,553 forecasts in seconds on the 24th May 2018 to allow us to publish this summary in less than an hour. She can turn these into PowerPoint slides and Audio files in minutes too as you wish, or we can prepare a full customized and professionally written brief for you to order covering all 18,553 forecasts.

.jpg)

Athena

Athena does show duplicates to aid your understanding of themes as well as contradictory forecasts. She may also show near-duplicates. You can speed read past the duplicates and near-duplicates if you wish, though the latter may show additional information. You can use the contradictory, and likely uncertain forecasts she finds to imagine different scenarios. The future is unpredictable, but we can examine the possibilities and choose our preferable future from the choices she presents.

Athena is apolitical. She will report forecasts from different viewpoints however distasteful that might be to our own values. Wearing rose-colored glasses is not her purpose; reporting potential futures is. So, we recommend you check her veracity before responding to her extracted forecasts.

Just like humans, Athena can be fallible. Do recognize that you and your associates are biased too. But whereas you tire, make mistakes and only recognize what interests you, she does not. She might miss or misinterpret as you do, but with far less frequency and she'll take uncomfortable truths and alternative ideas in her stride. But, please let us know if you feel her bias can be reduced. We want to do our best for you. And, as with any research, you should check and triangulate her findings for yourself.

Keep up to date: You can stay bang up to date on this topic or choose from our many automatic reports to determine what's next in seconds.

Global goals | Social changes | Sector prospects | Risks & opportunities | Year-by year | G20 watch | Key Organizations

You can also ask us to set-up private topics for you (clients only) to achieve the same thing as this Trend Alert for your associates or set up Email subscriptions (Registration required) on your favorite subjects.